Wire B2C (UX & UI)

Wire B2C (UX & UI)

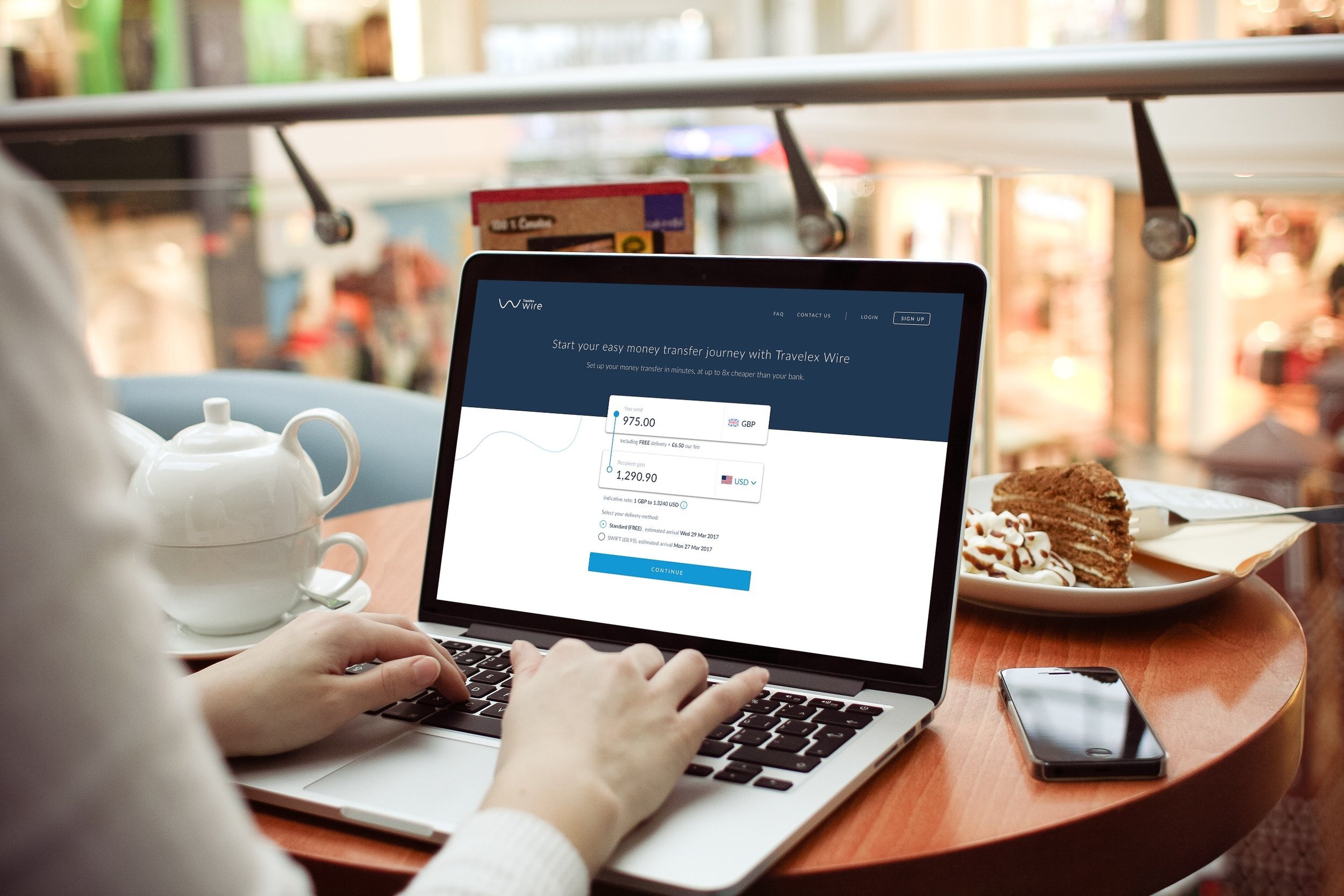

Wire International Payments B2C

OVERVIEW

Wire is a web application that allows customers to send money abroad in a few simple steps.

Following the launch in March 2018, the Wire team have come together again to look at a number of improvements that could potentially be made to enhance the user journey and improve conversion. Below are several examples of work I had done as part of Wire optimisation process.

New on-boarding experience

When Wire was launched, new customer registration and login were displayed in a light box. While for login this didn’t present huge issues, registration process was not ideal. The key issues were lack of substantiation why someone should sing up to Wire and also that the registration required a number of personal details to be added for KYC procedure (Know Your Customer) and light box wasn’t the best pattern to be used in this context. In order to address this issue I proposed 3 different approaches that could remediate the problem.

Approach 1 - Social proof

approach 2 - pathos, logos, ethos

approach 3 - split screen

2. Referral programme

In order to optimise acquisition costs of new customers I designed a flow for Referral programmes that would allow to get new customers with a low risk to the business.

3. Multi-currency accounts

The goal for Multi-Currency Accounts (MCA) was to strengthen Travelex’s profile as a leading international payment service provider and drive a new income stream for Travelex globally. The solution would involve building product enhancements that will form a Multi-Currency Account functionality into the Wire payments platform.

As part of the business case I designed and built a prototype for Multi Currency Accounts on the Wire platform and 2FA (2 factor authentication on the mobile app).

4. Guaranteed rates

Due to rate fluctuations in mid market rates, it is possible that the rate may change during the time the payment transaction is processed, resulting in different total billed to the customer. In order to allow customers to make informed decisions about their payment and to ensure that they know exactly how much money they are sending and how much their recipient is getting and at what rate we implemented guaranteed rates. Below are examples of two explorations: timer and pop up notification.

Rate change timer

Rate change pop up